Because of international security reasons there are strict rules regarding the export and transit of dual-use goods. These rules are based on the European Dual-Use Regulation. For export to countries outside the European Economic Community an authorisation is required. Its purpose is to prevent dual-use goods from falling into the wrong hands after export and subsequently being used for terrorist purposes. Dual-use goods are goods that be may be used for dual purposes.

Therefore product classification of your goods is of the utmost importance. Does your product qualify for dual-use product classification?

Which products are dual-use classified?

- Systems, equipment, parts and components

- Test, inspection and production equipment

- Materials

- Software

- Technology

- Chemical substances

Various agreements have been signed globally. If these agreements are not complied with, sanctions and fines may be imposed. This may have a major impact on your company and will result in criminal cases and boycott by other countries. Your employees may also be held severally liable by the government.

A dual-use compliance risk assessment is of extreme importance for each company exporting goods. This may also apply to your company.

By being compliant your company prevents its products from unintentionally falling into the wrong hands.

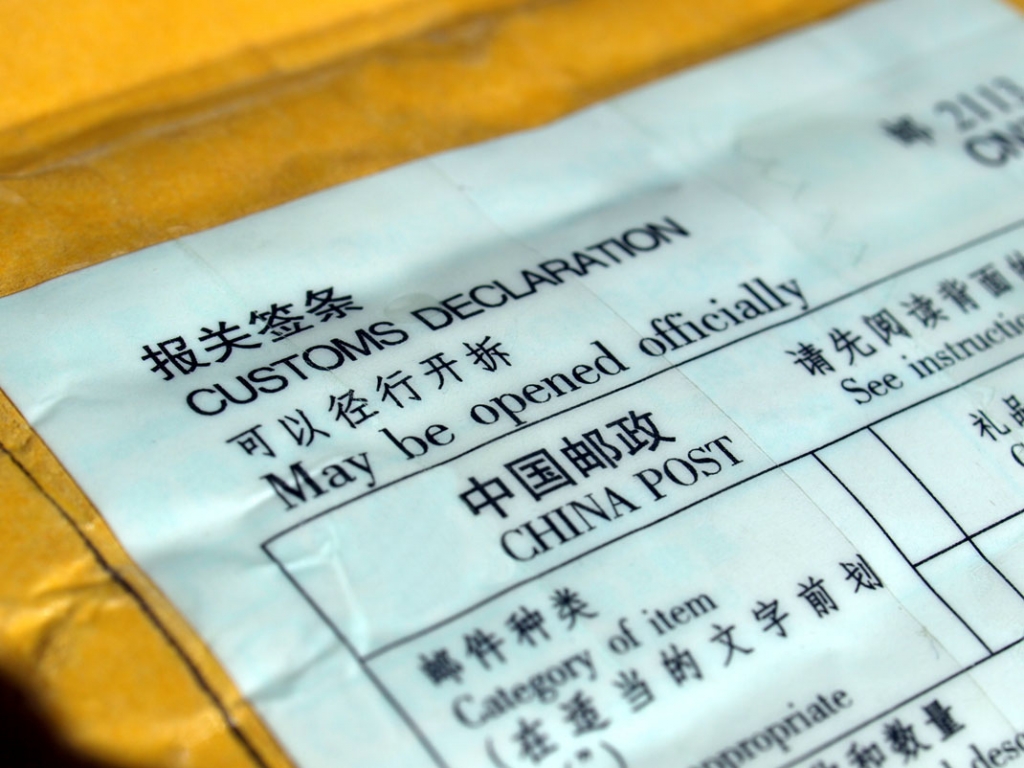

Contrary to popular belief the dual-use regulation also applies to goods stored in transit in a bonded warehouse and which are transited under customs document T-1.

Whether importing, transiting or exporting goods, our advice would be to check if your commodity code complies with the commodity code as laid down in customs legislation.

By using our Export Control service, Global Customs Consultancy is able to guarantee its customers are compliant and act accordingly.

If your company is interested, Global Customs Consultancy can screen your products and their corresponding HS codes in our Export Control tool. In a concise and clear report we will convey our findings and we will discuss any possibly required follow-up actions.

If you are interested, please do not hesitate to contact us:

Global Customs Consultancy

info@globalcustomsconsultancy.com

Phone: +31(0)657136245